For general inquiries or questions please contact us at info@pbafglobal.com.

Roel Nozeman is Programme Director of PBAF and Nature Lead at NN Group. With a diverse background in both the financial and the environmental sector he strives to bring these different worlds together and contribute to a sustainable future.

Wijnand Broer is Program Manager at PBAF and partner at CREM, a Netherlands based consultancy in the field of sustainable development. Wijnand has specialised in the areas of Corporate social responsibility, Business & Biodiversity, Natural Capital and Socially Responsible Investment.

Biodiversity is short for ‘biological diversity’, referring to the variety of all life on earth. PBAF uses the definition of the reputable ‘Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services’, IPBES:

“Biodiversity is the variability among living organisms from all sources including terrestrial, marine and other aquatic ecosystems and the ecological complexes of which they are a part. This includes variation in genetic, phenotypic, phylogenetic, and functional attributes, as well as changes in abundance and distribution over time and space within and among species, biological communities and ecosystems.”

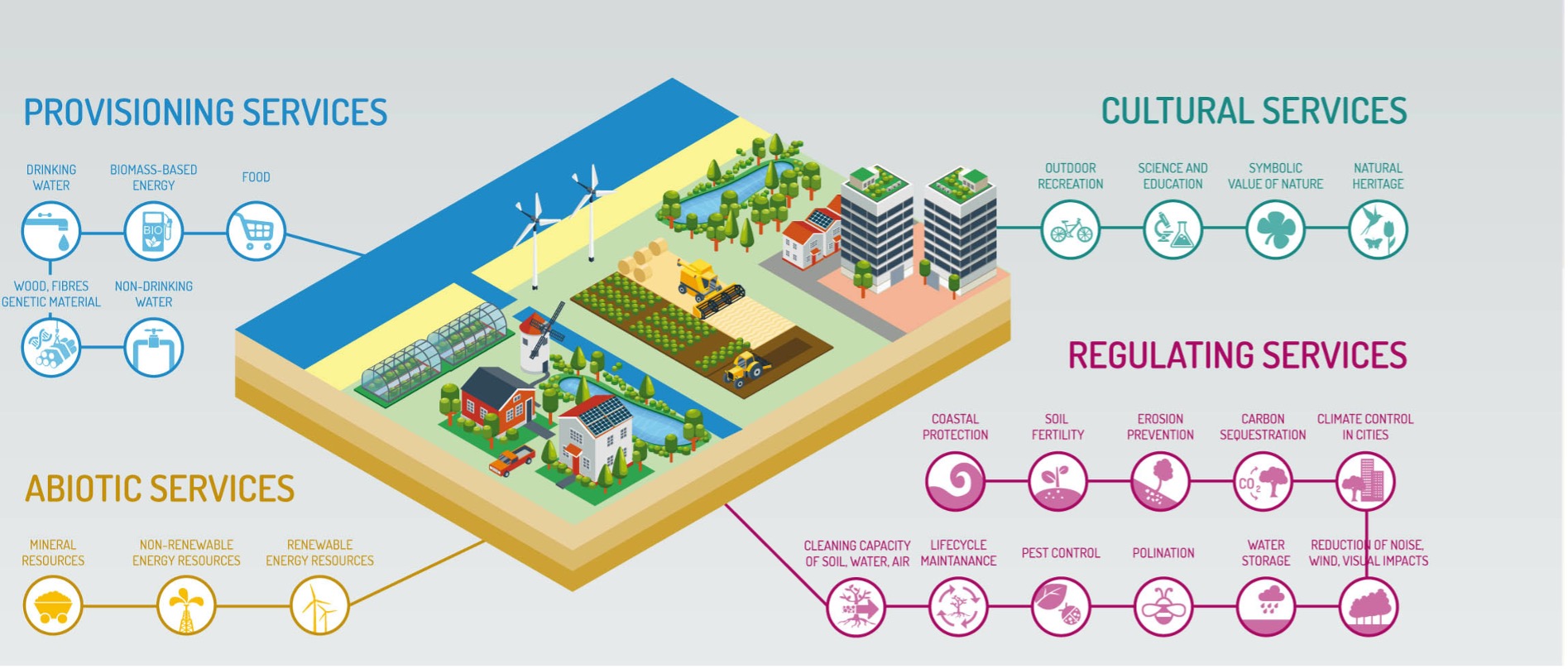

Biodiversity underpins the services that nature provides, like carbon sequestration, water purification, pollination and the provision of food and fibres. All economic activities depend on the provision of ecosystem services and biodiversity plays a key role in climate change mitigation and adaptation. The provision of these services has always been taken for granted but is increasingly at risk due to the loss of biodiversity.

The ability of an ecosystem to deliver the services we depend on reduces when the system is less biodiverse. This is affecting companies and can lead to (1) physical, (2) reputational and (3) transitional risks for investors. An example of a physical risk is the reduction of crop yield due to a reduction of pollinators affecting crop pollination. Reputational risks can arise from the loss of biodiversity underpinning services used by local stakeholders, like clean water. Transitional risk can arise when consumer preferences change and legislation is put in place to halt the loss of biodiversity, like an increase in protected areas, affecting economic activities. By addressing the loss of biodiversity now, risks can be managed and investment opportunities can be identified.

Adapted from PBL, 2014

PBAF is the abbreviation of the Partnership for Biodiversity Accounting Financials, run by the independent PBAF foundation. It is an industry-led initiative that develops the ‘PBAF Standard’. The PBAF Standard enables financial institutions to assess and disclose impacts and dependencies on biodiversity of loans and investments. PBAF is aligning its work with important initiatives like the Taskforce on Nature related Financial Disclosures (TNFD), the EU Align project, PCAF, the Science Based Targets network, GRI-EFRAG, the Capitals Coalition, the Finance for Biodiversity Pledge and many more. PBAF develops the PBAF Standard in close cooperation with the participating financial institutions and the PBAF ‘Sounding board’. The Sounding board consists of non-governmental organisations (NGOs, like nature conservation organisations), and experts in the field of finance and biodiversity and biodiversity impact assessment.

PBAF was initiated in 2019 by ASN Bank and founding partners ACTIAM, FMO, Robeco, Triodos and Triple Jump with the mission to enable financial institutions to assess and disclose impacts and dependencies on biodiversity of loans and investments. The PBAF Standard is defining what is needed from biodiversity impact and dependency assessments and the resulting data, in order for these assessments to deliver the information financial institutions need to act upon.

There is a growing awareness among financial institutions that impacts and dependencies on biodiversity play an important role, both from a risk and from an opportunity perspective. Economic sectors impact on biodiversity and depend on the ecosystem services nature provides. These services are increasingly at risk as a result of the loss of biodiversity.

Through their investments, financial institutions can play an important role in the conservation and sustainable use of biodiversity, contributing not only to the biodiversity targets of the Convention on Biological Diversity (CBD), but also to the reduction of investment risks. For financial institutions to take up this role, the availability of science based, reliable impact data is an important precondition. This is where PBAF comes in, as a standard setting initiative.

Apart from the requirements and recommendations in the PBAF Standard, PBAF also provides practical guidance to financial institutions to take the first steps in impact and dependency assessment.

PBAF is the sister-initiative of PCAF (the Partnership for Carbon Accounting Financials) which has now grown into a truly worldwide initiative, used by 200+ financial institutions all over the world.

A Carbon Footprint and a Biodiversity footprint have many similarities and some differences. A Carbon footprint is focussed on the drivers (e.g. CO2 emissions) causing Climate Change. A Biodiversity footprint is focussed on the drivers causing Biodiversity Loss. By calculating a Biodiversity footprint an investor gets a better view of the interdependencies of Climate Change and Biodiversity Loss and potential trade-offs. Both footprints use pressure-impact models that are based on best available science.

Becoming a PBAF partner or supporter is possible for financial institutions of all sizes, on all continents, and loans and investments at every scale. PBAF supporters are regularly updated on the latest developments in the area of biodiversity impact and dependency assessment in the financial sector. Becoming a supporter is free of charge. PBAF partners pay a small annual fee and enjoy the following benefits in return:

Click here for the up-to-date list of partners and supporters of PBAF.

The organisational structure of PBAF (see figure below) is set up with the aim to provide a solid and scalable platform fit for growth and suited to accomplishing the partnership’s mission and goals.

PBAF is financially supported by the IKEA Foundation and PBAF partners pay a small annual fee.